Cannabis Industry Check-in 2023

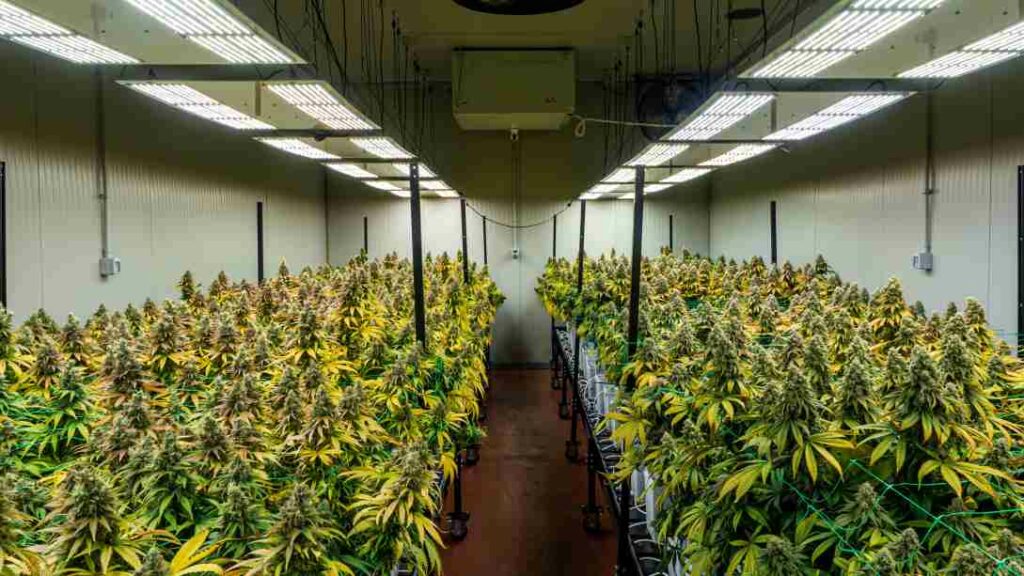

Hey there folks! The cannabis industry in Canada has been having an interesting couple of years; with lots of ups and quite a few downs. While the weed has gotten better and better, some of the licensed producers that have been crafting said weed have experienced some…shall we say turbulence, while trying to make their dreams come true. So, let’s take a look at the how’s and why’s of the cannabis industry and its current state.

How is the electric lettuce business going?

Well, that question doesn’t have a simple answer. There are a few growers and brands that have been absolutely killing it, while others have been gobbled up by bigger brands or have fallen victim to the age-old issue of financial woe. The reasons for this are legion but effectively break down to a combination of idiotic, gratuitous overspending and an unreasonable tax structure for cannabis producers.

Dude…that’s harsh.

Harsh? Yes. Sadly true? Yes. Without going into too much detail and naming names, some of the biggest brands in the industry have been losing money hand over fist and filing for credit protection due to rolling out their businesses at breakneck speeds with no attention being paid to the finer details of how to grow their business at a reasonable pace with an organic and intelligent structure that considers market and business trends. That and, plainly put, they grew too much weed. More than they could reasonably sell to be honest. This being a relatively new industry, some of these folks can be forgiven for not having the foresight to structure their business growth properly….but most of them should’ve known better. These companies are sadly, going to eventually go the way of the dinosaur or be assimilated by another company or investor. Taking all of this into account with the tax structure that the government has hampered these companies with, and it can be challenging for them to succeed.

How are taxes structured for these companies?

Full disclosure, I understand taxation in the same way that I understand sudoku; I put numbers in a box and occasionally get angry and yell at the numbers because they aren’t adding up to what I want. So, put simply, I’m not a numbers guy. With that in mind, lets see if I can explain this. Like all businesses, cannabis producers are taxed on their income and the product they produce. Where things get exorbitant is the excise tax that is currently being applied to cannabis. An excise tax is an internal tax applied to the manufacture or sale of a product or commodity. It’s a tax generally applied to (bluntly put) hobble an industry that produces products that are perceived to have potentially harmful effects, like smoking. To be honest, it’s an arbitrary tax that provides no discernable benefit to the industry it’s applied to and no quantifiable benefit to the society in which it exists. Simply put, it’s another way for the government to get a bigger piece of the pie without giving much if anything back. Particularly in the manner in which this tax is applied in the cannabis industry, with producers paying upwards of a 25% excise tax on their products. Which is kind of insane.

Wow, that’s quite the set of hurdles to overcome

As Macho Man Randy Savage once said, “You ain’t wrong brother.”. Many cannabis companies are struggling under the weight of poor planning, execution, and overwhelming taxation. However, as I mentioned above, there are plenty of cannabis companies who are led by people who have great heads for business and are growing at a steady, profitable and (most importantly) sustainable pace.

Anyway, that is my very bare bones inside look at why some of the cannabis companies in Canada are presently struggling. There are many calls being made for a change to the taxation structure to help alleviate the plight of licensed producers, so hopefully we’ll see a change soon. For right now though, keep supporting the growers you love and trust to help them keep producing dank weed.